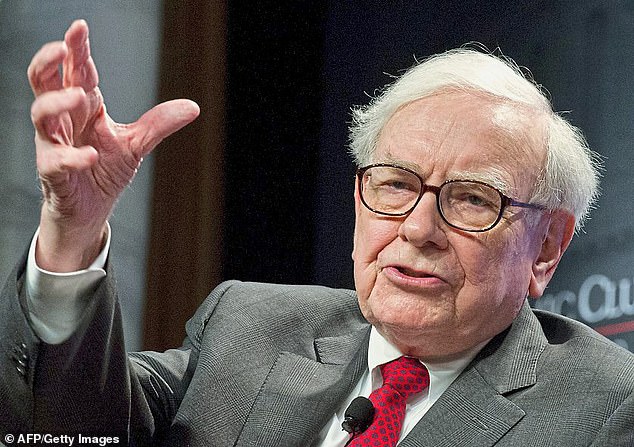

US investing legend Warren Buffett brands Spac boom ‘a killer’ as he criticises greedy City advisers

US investor Warren Buffett has branded the Spac boom ‘a killer’ as he criticised greedy City advisers.

The 90-year-old became the latest to slam Spacs – or Special Purpose Acquisition Companies – at the weekend shareholder meeting of his company Berkshire Hathaway.

Spacs, also known as ‘blank cheque companies’, are empty firms which list on the stock market, raising millions from investors with the purpose of buying an existing company.

Raising concerns: Warren Buffett became the latest to slam Special Purpose Acquisition Companies

Usually led by a prominent investor, they have become increasingly popular in the aftermath of the pandemic.

‘It’s a killer,’ said Buffett, explaining that the amount of money being funnelled into Spacs meant they now had the edge over companies like his when deal-making.

Buffett’s right-hand man Charlie Munger said many City firms and hotshot investors launching Spacs were not buying companies ‘because it’s a good investment. They’re buying it because the adviser gets a fee. And of course, the more of that you get, the sillier your civilisation is getting’.

Munger said the boom also indicated a ‘moral failing’ because City advisers were making ‘easy money’.

He added: ‘I think we have a lot to be ashamed of in current conditions.’

Advertisement